A major achievement in China: the world’s first recovery for type 1 diabetes

A major achievement in China: the world’s first cure for type 1 diabetes

A revolutionary medical advance

For the first time, a 25-year-old Chinese woman has been completely cured of type 1 diabetes thanks to a therapy developed by Chinese researchers. The approach, carried out at Tianjin Main Hospital in collaboration with Peking University, is based on cell regeneration. The researchers took cells from the patient’s pancreas, which they then chemically treated to return them to a stem cell state. Once modified, the cells were re-implanted into the patient’s pancreas via a micro-invasive route. Following this operation, the level of insulin secreted increased by 700%. The results of this operation were rapid and long-lasting: as early as 75 days after the operation, blood sugar levels were regulated without the need for external insulin injections, and the patient no longer had any symptoms of diabetes. This complete cure marks a major therapeutic revolution.[1]

A silent epidemic

Despite this progress, diabetes remains a real public health emergency. With more than 140 million people affected, China has one of the highest prevalence rates in the world, representing around 12% of its adult population[2] . By 2040, China could have 166 million diabetics, consolidating its position as one of the most affected countries.[3] Worryingly, type 2 diabetes also affects 1.77% of Chinese children aged between 3 and 18[4] . Added to this is a lack of awareness: only 36.5% of Chinese diabetics are aware of their condition and, of those who are treated, less than half (49.2%) manage to control their blood sugar levels effectively[5] . The complications associated with diabetes are numerous and can be serious[6] :

- Cardiovascular disease: the main cause of death among diabetics.

- Kidney problems: kidney failure is common.

- Neurological and ocular disorders: neuropathy, which can lead to blindness, is also common.

The underlying causes of this epidemic

Diabetes in China is not just a question of genetic predisposition. Several social, economic and environmental factors are converging to fuel this crisis.

Urbanisation

The rapid development of cities in China has transformed lifestyles. Urban populations, which make up a growing proportion of Chinese society, have a much higher prevalence of diabetes than rural areas (12.1% compared with 8.3%).

Dietary changes

Changes in eating habits have also played a crucial role. The increased consumption of sugars, processed foods and fast food among affluent populations puts them at greater risk of diabetes. This transition, once limited to large cities, is now spreading to rural areas as a result of increasing access to industrial food products.

A sedentary lifestyle and stress

With the rise of office jobs, physical activity has declined considerably. At the same time, the urban environment and growing socio-cultural challenges are generating chronic stress, known to disrupt hormonal and metabolic mechanisms.

An ageing population

Like many countries, China’s population is ageing rapidly. This phenomenon mechanically amplifies the prevalence of diabetes, a disease that affects the elderly to a greater extent.

Strategic solutions: prevention rather than cure

To curb the diabetes epidemic, China is investing in prevention and awareness-raising policies:

Education and screening

By raising awareness of diabetes, it is possible to increase the rate of early detection and appropriate management.

Encouraging a balanced diet

Promoting high-fibre, low-sugar diets helps to improve the health of at-risk populations.

Promoting physical activity

Incorporating exercise into the daily routine through incentives, promoting the benefits of sport and creating more accessible infrastructures in urban areas could help to reduce the prevalence of the disease.

Strengthening medical infrastructures and equipment

Rural areas still lack the resources to diagnose and treat diabetes effectively. Strengthening the capacity of local healthcare centres is essential to bridge this gap. Massive investment in diabetes management equipment such as glucometers, insulin pumps and other innovative medical devices is being made to meet this public health challenge.[7]

A land of opportunity for foreign companies

The fight against diabetes in China offers many opportunities for European and French companies, particularly in :

- Innovative medical devices such as connected glucometers.

- Digital solutions for monitoring and managing diabetes.

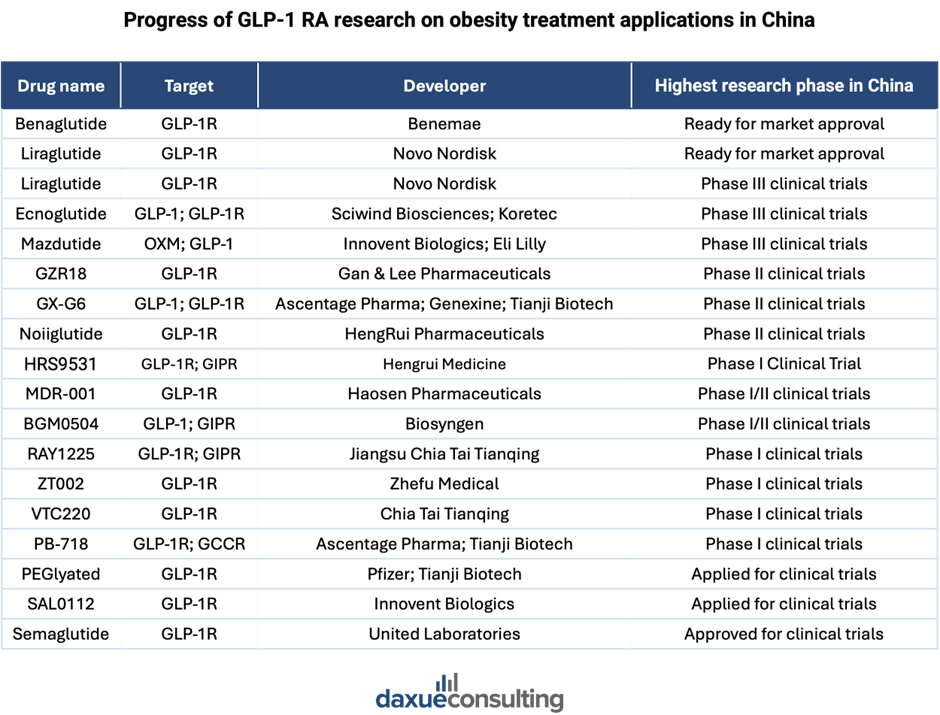

- Advanced treatments (such as GLP-1 drugs like Ozempic), both for diabetes itself and for its complications.

The key to success lies in an in-depth understanding of the local market, the players involved and the regulations in force. VVR Medical, a division of VVR International and an expert in the Chinese pharmaceutical and medical markets, supports companies in their development strategy in China.

[1] World first: Chinese woman cured of type 1 diabetes

[2] https://www.federationdesdiabetiques.org/information/diabete/chiffres-monde

[3] https://fr.statista.com/statistiques/571668/pays-avec-le-plus-grand-nombre-previsionnel-de-personnes-diabetiques-en-2040/

[4] https://www.thelancet.com/journals/lanpub/article/PIIS2468-2667(24)

[5] https://www.dbl-diabete.fr/tout-sur-le-diabete/societe/classement-diabete-pays-monde

[6] https://www.thelancet.com/journals/lanpub/article/PIIS2468-2667(24)

[7] https://www.mordorintelligence.com/fr/industry-reports/china-diabetes-devices-market/market-size