RAW MATERIALS INDEX RATE – DECEMBER 2018

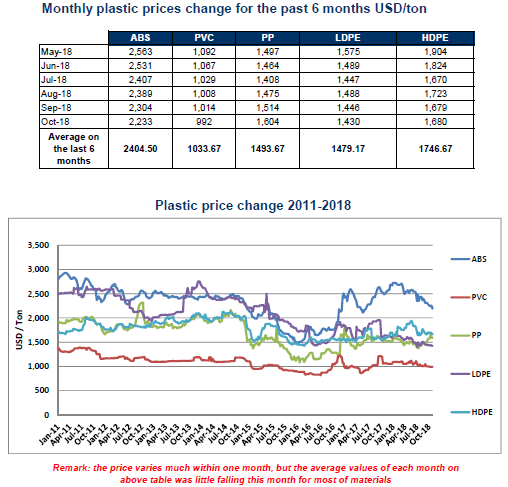

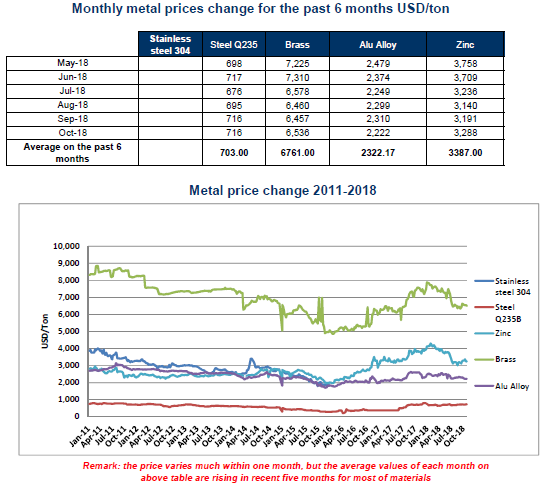

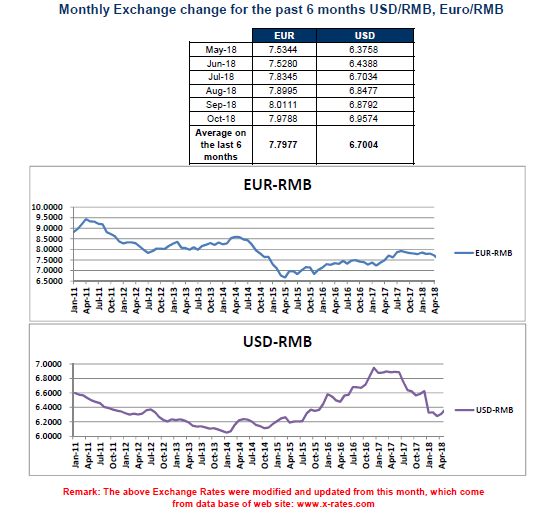

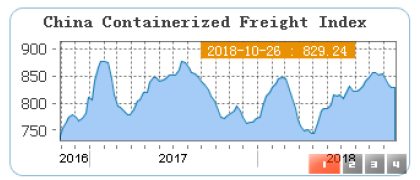

Here-under, the index rate of raw materials in China throughout the last 6 months.

Available in PDF : Download Newsletter VVR 2018 NOVEMBER

VVR International advises TRASIS on the acquisition of its distributor and the creation of its joint venture in China

VVR International advises TRASIS on the acquisition of its distributor and the creation of its joint venture in China VVR International assisted TRASIS, a global leader in nuclear medicine equipment, in structuring, negotiating and signing the acquisition of its distributor, as well as setting up a joint venture with its long-standing Chinese partner, Beijing PET...

The main traditional and commercial celebrations in China: holidays in 2025

The main traditional and commercial celebrations in China: holidays in 2025 China, with its thousand-year-old history, is a country where tradition and modernity coexist. Traditional festivals play a central role, combining ancestral rituals with family gatherings. Alongside these cultural celebrations, commercial festivals, often inspired by global trends or local initiatives, complete the calendar of key...

Generative artificial intelligence in China: a rapidly expanding technological revolution

Generative artificial intelligence in China: a rapidly expanding technological revolution Generative artificial intelligence (AI), a technology that enables the creation of textual, visual, audio and other content, is developing rapidly in China. With applications ranging from artistic creation to scientific research, not forgetting improved business services, this technology is becoming a strategic pillar of innovation....

Shanghai, Chine

7888 Humin Road, Minhang District

+86 21 3422 7164 103

contact@vvrchina.com

Guangzhou, China

Merchants City Home

495 Hanxi East Road,

Panyu District

+86 20 8332 1024

contact@vvrchina.com

Shijiazhuang, China

368 XinShi Bei Road,

Zhenxin Industry District

+86 3118 381 0103

contact@vvrchina.com

Sao Paulo, Brésil