Commercial success in China: Know Your Consumers

Commercial success in China: Know Your Consumers

The Chinese market may seem vast, but it is far from homogeneous. So while there are real opportunities for many business sectors, it is essential to study the structure of this market and its dynamics in advance. Indeed, if you want to do business in China for the long term, it’s essential to understand the mindset of the Chinese consumer. Influenced by a unique combination of traditional culture and modernity, these consumers have specific expectations that companies must recognize and satisfy.

Understanding the Chinese consumer

Understanding the Chinese consumer is the first step for any company looking to expand into China. A brief overview of consumer habits and interests.

Cultural values and their influence on buying habits

China, with its thousands of years of history, has a deeply rooted culture that can influence buying behavior. Certain values, such as respect for family and the value of saving, guide consumer choices and set the pace for certain purchases. For example, on special occasions such as Chinese New Year, it’s common to give expensive gifts to show respect and affection.

The Importance of Brand and Quality

Chinese consumers place a high value on brand reputation and product quality. A well-known brand is often associated with reliability and superior quality. For this reason, many foreign companies with a good international reputation have a clear advantage in the Chinese market.

The Role of Social Media and Influencers

With the rise of technology and the mass adoption of smartphones, social media plays an important role in the lives of Chinese consumers. Platforms such as TikTok have become essential sources of information for consumers. Influencers have a significant impact on purchasing decisions as they are perceived as reliable and authentic sources of information. They drive this digital commerce by offering live streaming on the main Chinese platforms, where they present products and generate a sometimes colossal volume of sales The rise of live streaming in China, a hot new sales channel – VVR International, strategic development, production, sourcing, distribution…

Meeting consumer expectations

Responding effectively to the needs of Chinese consumers requires an adapted and innovative approach, supported by a tailored marketing strategy and a multi-channel distribution network – Supply Chain & Distribution – VVR International, strategic development, production, sourcing, distribution… Here’s how companies can adapt to these expectations to ensure their success.

The Importance of Localizing Products and Services

China is a huge country with cultural and regional diversity. What works in one region may not be as effective in another. Therefore, localization of products and services is critical. This means not only language translation, but also adapting products, packaging and communication to local tastes, preferences and needs.

Customer service: a key element in gaining trust

Chinese consumers place a high value on customer service. Fast, efficient and courteous service can have a significant impact on brand perception. What’s more, word of mouth is powerful in China. A single bad customer experience can quickly spread across social networks and damage a company’s reputation.

Current and future trends to watch

The Chinese market is evolving rapidly. Companies need to stay on top of the latest trends and adapt accordingly. For example, the rise of e-commerce and certain platforms unknown in Europe, the growing importance of sustainability, and the appeal of local products are all trends that companies need to consider in their strategy.

Tips for foreign companies

Entering the Chinese market can seem daunting, but with the right strategies and a thorough understanding of the terrain, foreign companies can thrive. Discover some essential tips for successfully navigating this dynamic market.

Market Research and Local Partnerships

Before entering the Chinese market, it’s essential to conduct in-depth market research to understand local nuances. Working with local partners can also be advantageous, as they have intimate knowledge of the market and can help navigate the complex Chinese business landscape.

Adapt Marketing and Communications Strategies

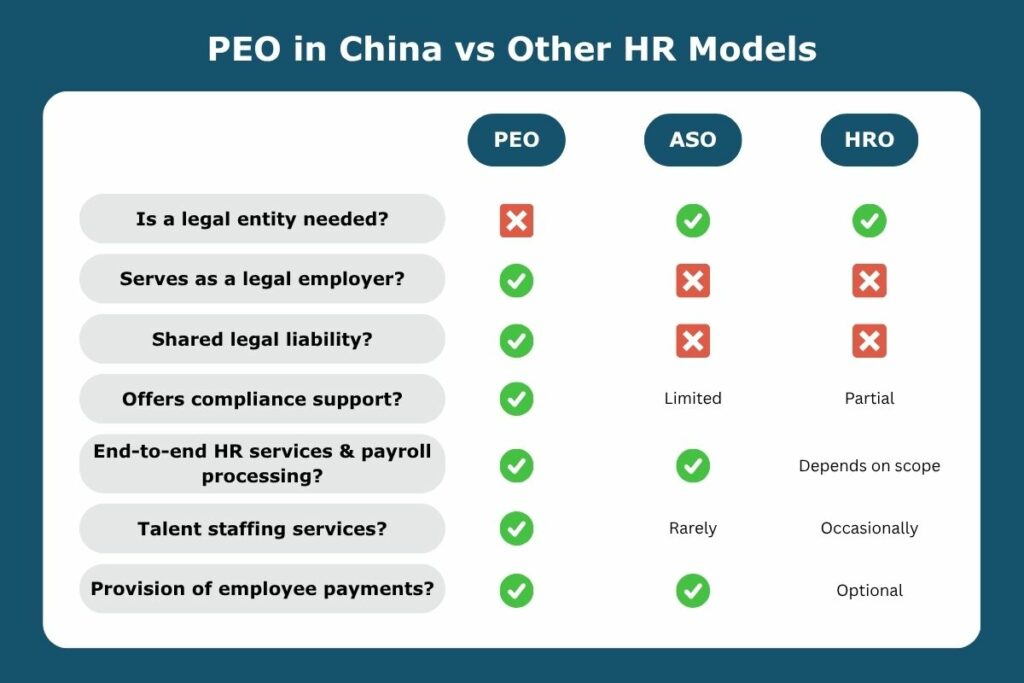

Marketing and communications in China are very different from those in the West. Companies must adapt their messages to resonate with Chinese consumers. This may include using local celebrities for advertising campaigns or participating in local festivals and events to increase brand exposure. Relying on a local employee to represent the brand or product in China is an advantage when launching in China. Thanks to Portage Salarial, it is possible to hire a Chinese sales representative without having to set up a legal entity in China. In fact, VVR International provides a legal home for your employee. As part of our “PEO services, we manage your employee’s administrative affairs and act as an intermediary for the payment of salaries and other fees;

Understanding Local Regulations and Standards

China has its own regulations and standards for trade, quality and safety. Foreign companies need to ensure that they comply with these regulations and keep abreast of developments to avoid legal problems. This may involve working with local experts or consultants to ensure compliance.

The bottom line: Navigating the Chinese market with confidence

China, with its ever-evolving market and demanding consumers, offers immense opportunities for companies that are able to adapt and innovate. By focusing on localization, building strategic partnerships, and staying on top of the latest trends, companies can thrive in the Chinese market.

With over 24 years of experience, VVR International has assisted numerous European companies in their industrial and commercial development in China. Whether you’re looking to establish local brands, sell through distribution networks, recruit the best local talent on your behalf, or use the PEO services, VVR International’s teams are ready to assist you in your development project.