The Cosmetics Market in China: developments and outlook

The China Beauty Expo (CBE) 2024, held in Shanghai from 22 to 24 May, brought together more than 10,000 brands and 70,000 beauty products, from global giants such as L’Oréal and Shiseido to trendy niche brands and national leaders such as Proya and Bloomage Biotech. More than 1,500 companies from the beauty supply chain were also present on 100,000 m² of exhibition space. This event is a showcase for the vitality of this sector in the Chinese market.

Indeed, the Chinese beauty market is growing by leaps and bounds, making it one of the most dynamic and lucrative in the world. With a population of over 1.4 billion and a rapidly expanding middle class, demand for beauty products continues to grow. This article explores the key factors behind this growth, as well as the emerging trends that are shaping this market.

Focus on the Chinese cosmetics market

Is the growth of the cosmetics market in China sustainable?

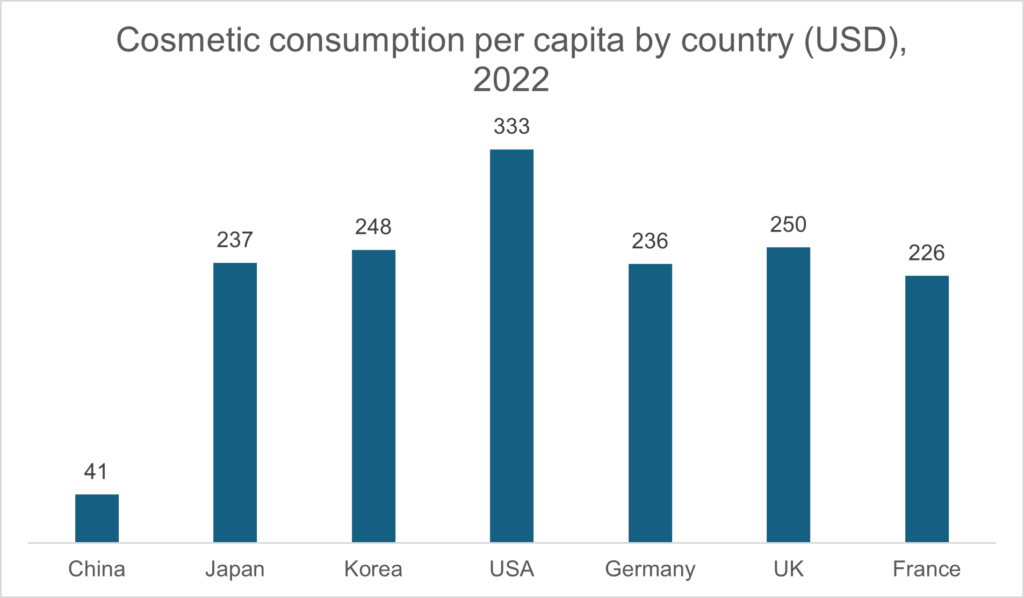

China has become the second largest cosmetics market in the world, just behind the United States. According to data from Statista, the Chinese cosmetics market will be worth more than 390 billion yuan (around $60 billion) in 2023. It is interesting to note that, although China is the world’s second largest market, per capita cosmetics consumption is significantly lower than that of US consumers. In fact, in 2022, the average American will spend $333 a year on beauty products, while the average Chinese will spend just $41. The growth potential of the Chinese market is therefore considerable.

However, following strong growth between 2018 and 2022, with an average annual growth rate of almost 10.7%, the market is expected to fall slightly to around 7% per year over the next 5 years. This expansion is underpinned by several factors:

However, following strong growth between 2018 and 2022, with an average annual growth rate of almost 10.7%, the market is expected to fall slightly to around 7% per year over the next 5 years. This expansion is underpinned by several factors:

Urbanisation and rising incomes:

Migration to urban areas and rising disposable incomes have led to increased demand for sophisticated beauty products.

Growing awareness of beauty and well-being:

Chinese consumers are attaching increasing importance to their personal appearance and well-being, boosting demand for skincare and make-up products. The dietary supplements market is also benefiting from this growing interest in well-being (for more information, see our dedicated article: The vitality of the dietary supplements market in China – VVR International, strategic development, production, sourcing, distribution… )

Influence of social media :

Social media platforms such as WeChat, DouYin, Weibo and Xiaohongshu play a crucial role in the emergence of trends and the promotion of cosmetic products. In China, livestreaming on social networks is enjoying considerable success. During these lives, influencers test, comment and advise their followers on new products to buy. These livestreams are very popular, and can generate a lot of sales! (For more information on social selling and its influence in China, see our article: Focus on the extraordinary phenomenon of social selling in China – VVR International, strategic development, production, sourcing, distribution…)

Among foreign brands, France, Japan and Korea are the main importers.

Since 2022, France has dominated the imported cosmetics market, with a market share of over 24%, or 36.4 billion yuan (around 5.6 billion dollars). In China, the premium cosmetics market has historically been largely held by foreign brands, while Chinese brands have mainly exported products with low added value, creating a trade deficit in this sector. In recent years, however, there has been an increase in the power and quality of domestic cosmetics brands.

The rise of Chinese brands:

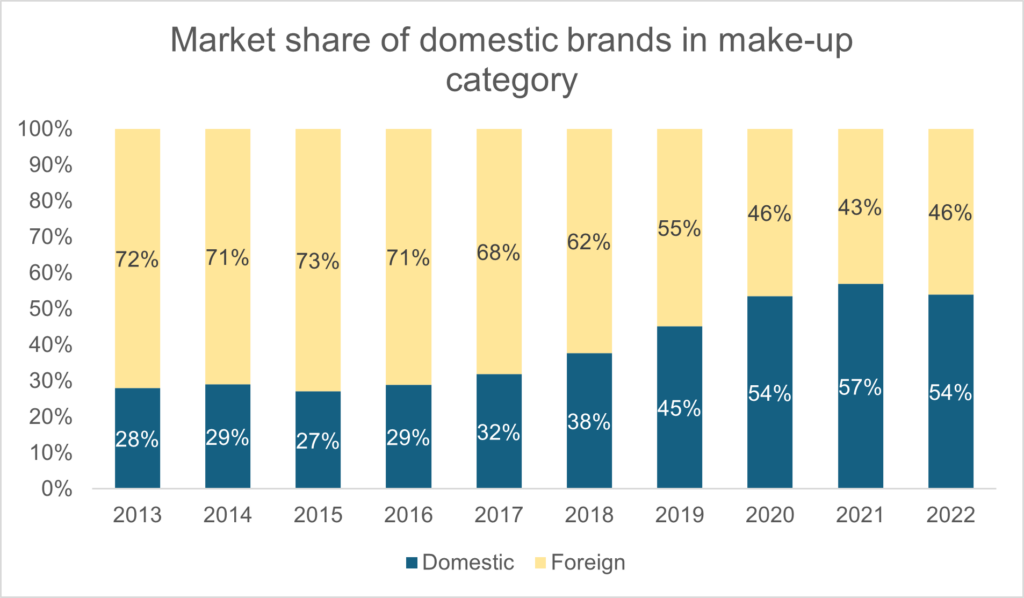

Until the 2010s, the skincare and cosmetics market was largely held by foreign companies. In 2013, for example, they accounted for 72% of the make-up market, compared with 46% in 2022. Today, buoyed by changing consumer habits, local Chinese brands such as Giant Biogene (巨子生物), Syoung (水洋股份), Proya, Jahwa, BTN or even Bloomage Biotech are gaining in popularity, rivalling the international giants. Since 2020, they have held more than 50% of the local make-up market.

This rapid development is due to three main factors:

This rapid development is due to three main factors:

- Firstly, these brands have been able to adapt more quickly than foreign brands to new consumption patterns and changing demand. Being closer to their consumers, they have observed and understood their changing habits. What’s more, they are often smaller companies, more agile in organising R&D and implementing marketing plans, and able to adjust their prices more easily. Companies such as Perfect Diary, Florasis and Chando have managed to capture the attention of consumers with products tailored to local preferences and innovative marketing strategies. What’s more, the distribution strategy chosen by these brands is often based mainly on online sales, which allows them to be more responsive (online sales are the preferred marketing method for these brands, as is the case with Proya, which achieves over 90% of its sales online).

- Secondly, young consumers are more inclined to consume national brand products. Generation Z represents almost 19% of the Chinese population, and includes many consumers of cosmetics. Born during a period of prosperity for China and its international influence, young people are proud to buy national brands, which creates excellent development opportunities for Chinese companies.

- Finally, the desired effects and specific functions of cosmetics have become increasingly important when it comes to purchasing products. Social networks and the internet have helped to raise awareness among the Chinese of skin problems and the various treatments available to deal with them. Domestic brands were quick to pick up on these new consumer concerns. They have been able to adapt, for example by increasing the number of partnerships with medical institutions in order to reinforce their image as experts in skin care. At the same time, they have consolidated their online distribution strategy.

Challenges and opportunities for foreign brands

French cosmetics: brand image and luxury

Brand image and the perception of quality play a crucial role in purchasing decisions. Chinese consumers are particularly sensitive to well-known brands and luxury products, which they associate with high social status and a guarantee of quality. Many French brands enjoy an image of luxury and quality that is highly prized by Chinese consumers. For example, brands such as Chanel, Dior and Lancôme enjoy strong recognition and loyalty from Chinese consumers. Made in France” is seen as a guarantee of prestige and quality, particularly in the skincare and fragrance segment.

Foreign brands can also capitalise on the growing interest in natural and organic products. Demand for products that are free from harmful ingredients and respect the environment is on the rise, paving the way for brands such as Caudalie and L’Occitane to promote their natural, sustainable formulas.

Adapting to the Chinese market: challenges for foreign brands

Enhanced regulations:

China is continuing to tighten its regulations on the safety and quality of cosmetic products. Brands must remain vigilant and ensure that they comply with these standards to avoid any risk of withdrawal from the market or penalties. Compliance with local regulations is essential to maintain the confidence of consumers and the authorities.

Establishing a suitable distribution network:

Beauty products are distributed in China through a combination of online and offline channels. E-commerce platforms such as Tmall and JD.com are still major players, but their leadership position is being challenged by social selling and the growing importance of livestreaming. Physical shops continue to play an important role, offering immersive shopping experiences and personalised consultations. In 2020, online sales of cosmetics accounted for around 38% of total sales in China. In recent years, the rapid expansion of cross-border e-commerce (CBEC) in China represents a major opportunity for foreign brands. Specialised CBEC online sales platforms such as Tmall Global and JD Worldwide give foreign brands direct access to Chinese consumers without the need to register their products. Participating in major online events such as the ‘Double 11’ can generate massive visibility and sales in a short space of time, however it is important to note that Chinese consumers will expect a strong discount on the price of products at these festivals.

Conclusion

In conclusion, the cosmetics market in China offers considerable opportunities for both French and foreign brands. However, success in this market requires an in-depth understanding of consumer preferences, an ability to innovate and personalise offerings, and constant vigilance with regard to local regulations. Brands that are able to navigate this dynamic and ever-changing landscape will be able to capitalise on the market’s continued growth and strengthen their presence in China. With a vast and diverse population, China continues to represent fertile ground for the global cosmetics industry, promising great prospects for years to come.